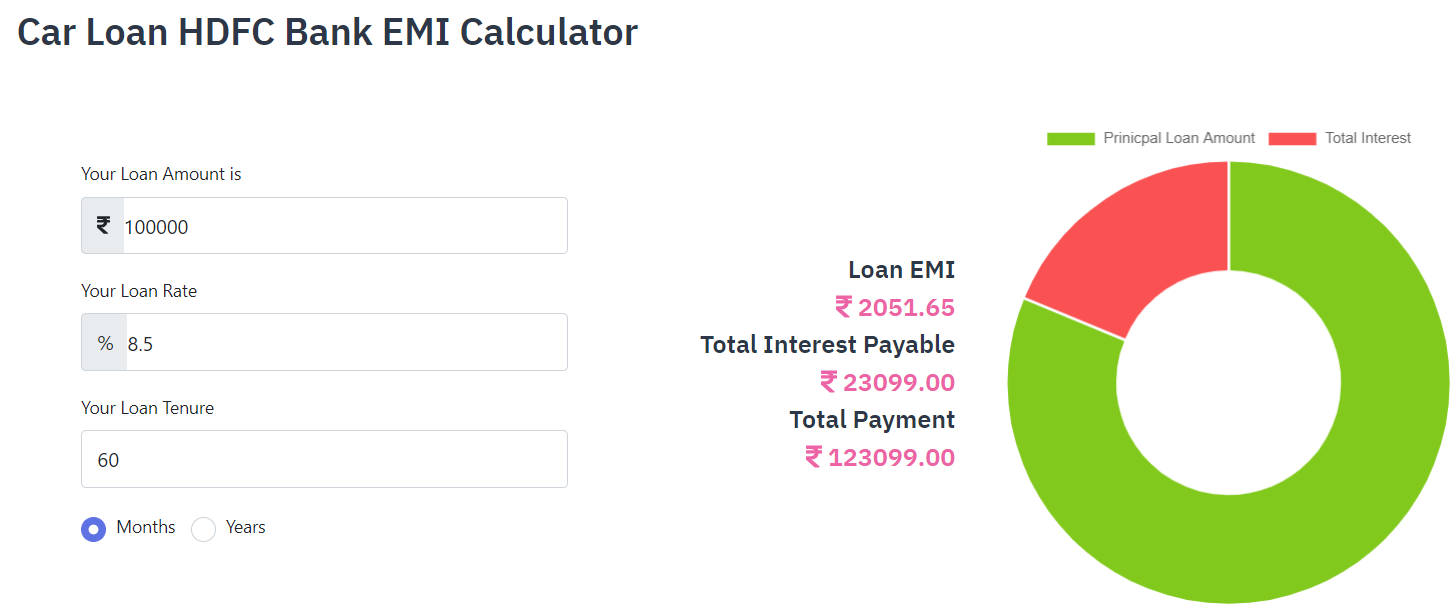

This calculator helps you calculate the EMI for your new or pre-owned car loan. It shows you the total EMIs, the amount of interest, and the principal amount that you’ll have to pay over the term of the loan. It’s free to use and requires no login. Use it whenever you’re in the market for a new or used car loan.

EMI calculator

An EMI calculator is a great tool to use when comparing car loans. It will allow you to compare the EMIs, duration, and interest rate of various car loans. Fixed rate of interest means that you will pay the same amount of interest over the term of the loan. The EMI calculator will help you spread the interest evenly over the entire period of the loan.

To use an EMI calculator, you simply need to input the details of the loan. The calculator will then calculate the estimated monthly payment based on the details entered. Some websites also show an amortization table, which helps you understand the repayment details. Enter the principal amount and the loan tenure, and the calculator will estimate your monthly installments. The longer the tenure, the lower your monthly payments will be.

EMI options

There are several ways to reduce your EMI on an HDFC Car loan. One option is to make the loan tenure longer, which lowers your monthly payments. But this option has one disadvantage: you will be paying a higher interest rate in the end. This option is suitable for borrowers who have higher monthly personal expenses.

The amount of your EMI is determined by several factors, such as the loan amount, loan tenure, and interest rate. As these variables change, so will your EMI. To get the most accurate EMI for your car loan, you can use an EMI calculator.

Pre-payment penalty

A pre-payment penalty is an additional fee you may have to pay if you decide to pay off the loan before the scheduled maturity date. This fee can be as high as 5 per cent of the outstanding amount. However, you can save money by opting for a longer loan term and a lower loan amount.

While some banks do not levy pre-payment penalties on car loans, HDFC Bank and ICICI Bank do. You should check with the banks’ policies before making any decision regarding your finance.

Loan tenure

HDFC Bank has an attractive loan scheme for its customers that gives them a choice of repayment tenure. This scheme is highly flexible and transparent. The application process is easy and the approval time is less than 10 minutes. Apart from this, you can avail comprehensive insurance coverage that protects you in case of a mishap. Furthermore, you can enjoy the convenience of a test-drive assistant.

In addition to this, the HDFC Bank has a section on its website for car loans that allows you to enter your details and submit your application. You can choose the loan tenure that best suits your needs and budget. Generally, HDFC offers the longest loan tenure of seven years. However, you should note that longer tenures incur more interest. For this reason, it is better to choose a shorter tenure and choose a lower interest rate.

Processing fee

If you are planning to buy a new car, you might want to consider taking an HDFC Car loan. The loan amount can be as high as Rs 3 Cr. HDFC Bank does not charge any processing fee until 24 months of repayment. To apply, you must be employed by a company that is profitable and has the cash flow to repay the loan.

HDFC also offers test drive assistance with a wide range of cars. This makes it easier for you to choose the one that best suits your budget and needs. The bank also offers an app that allows you to search for new and used cars and apply for a car loan.